Understanding the Federal Reserve’s Observance of Holidays in 2025

Related Articles: Understanding the Federal Reserve’s Observance of Holidays in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding the Federal Reserve’s Observance of Holidays in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Federal Reserve’s Observance of Holidays in 2025

The Federal Reserve, as the central bank of the United States, plays a crucial role in the nation’s financial system. Its operations, including the processing of payments and the management of financial markets, are essential for the smooth functioning of the economy. However, like any other organization, the Federal Reserve observes certain holidays, impacting its operations and potentially affecting market participants.

Federal Reserve Holidays in 2025

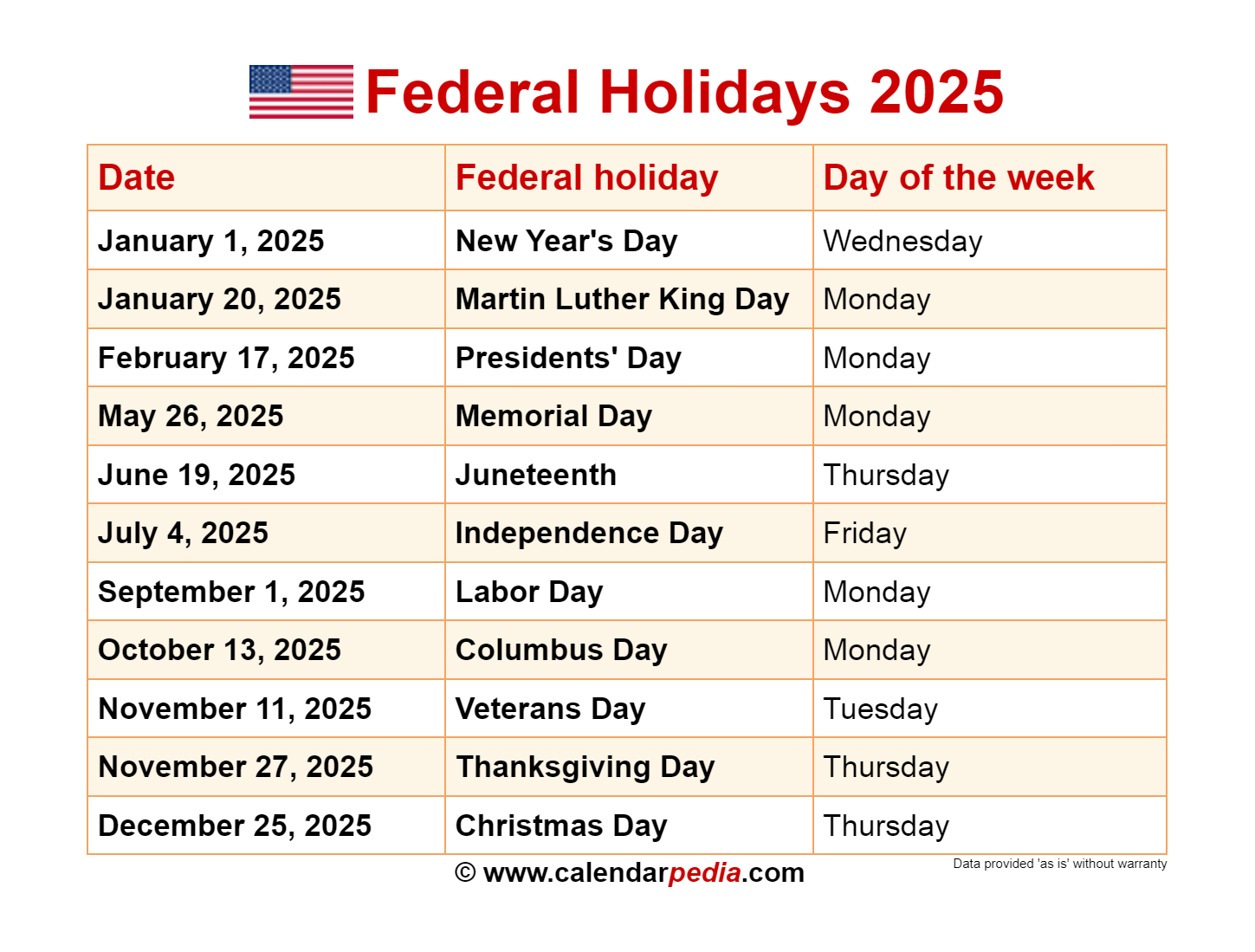

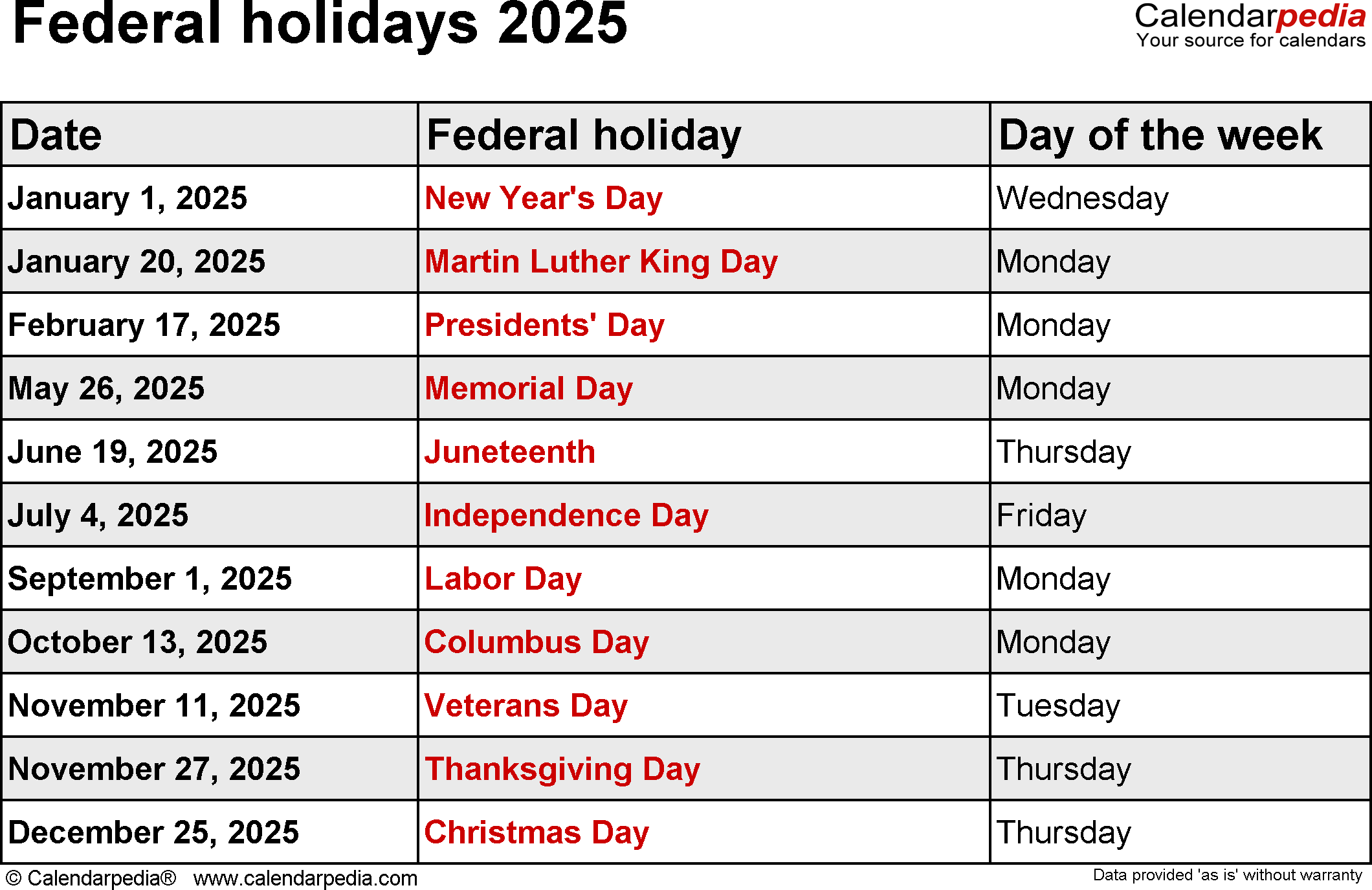

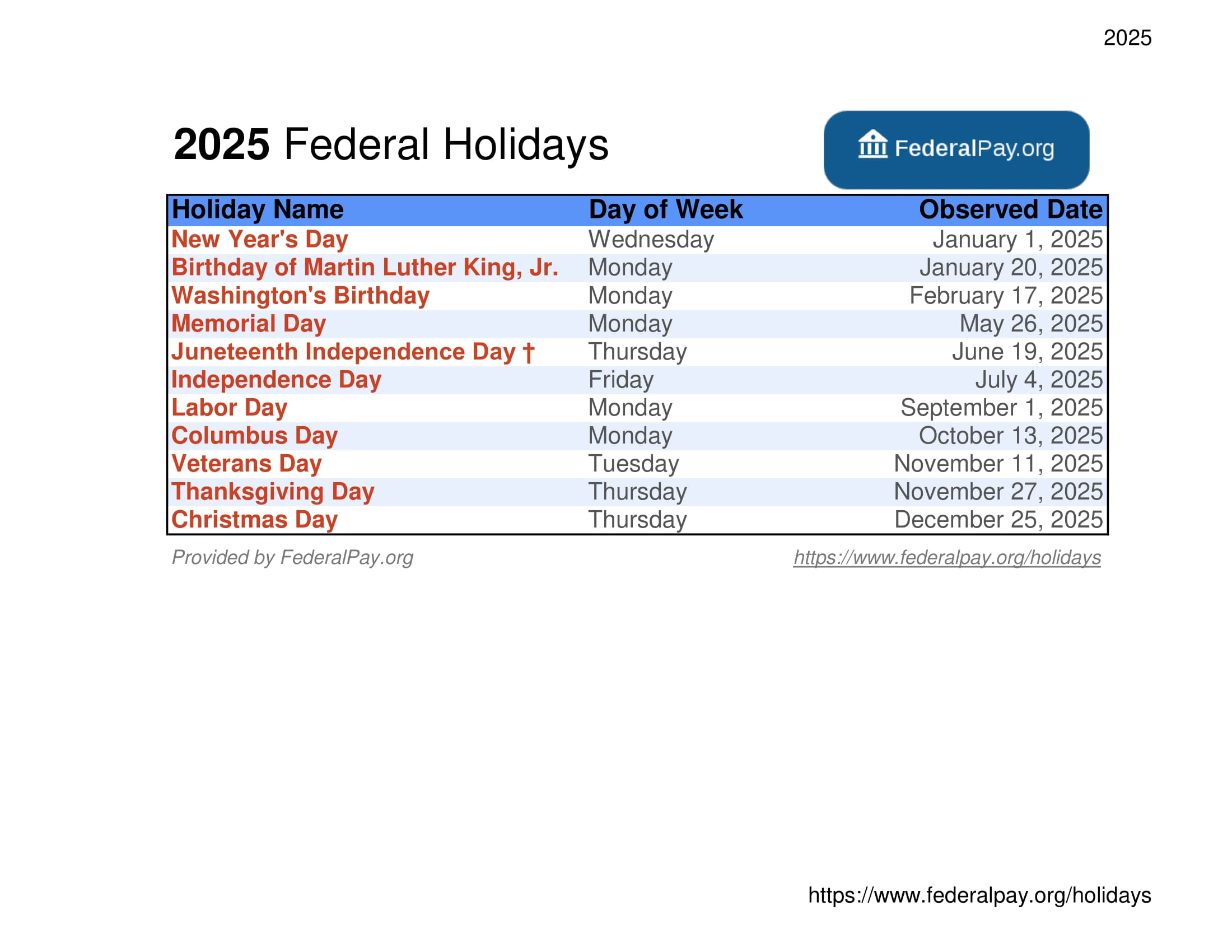

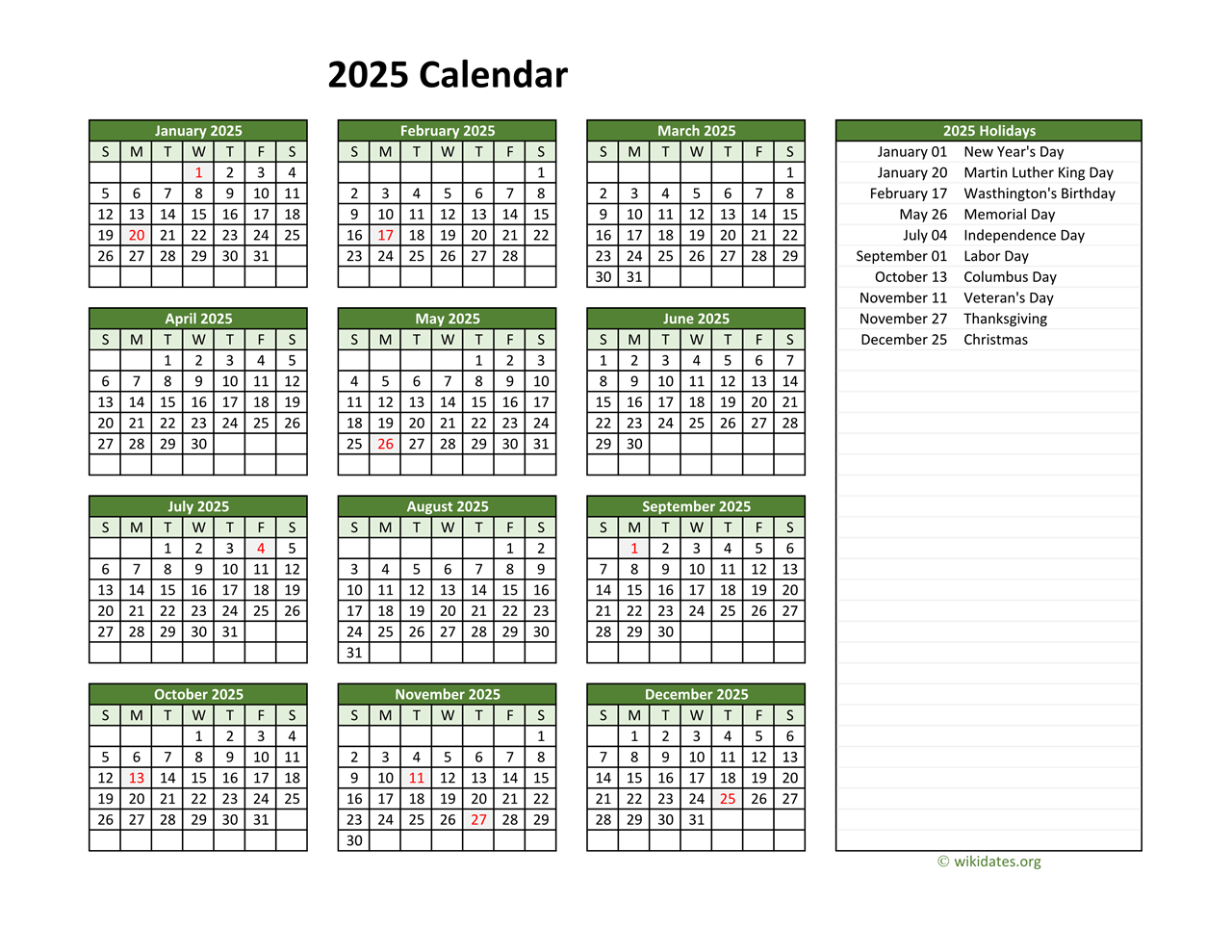

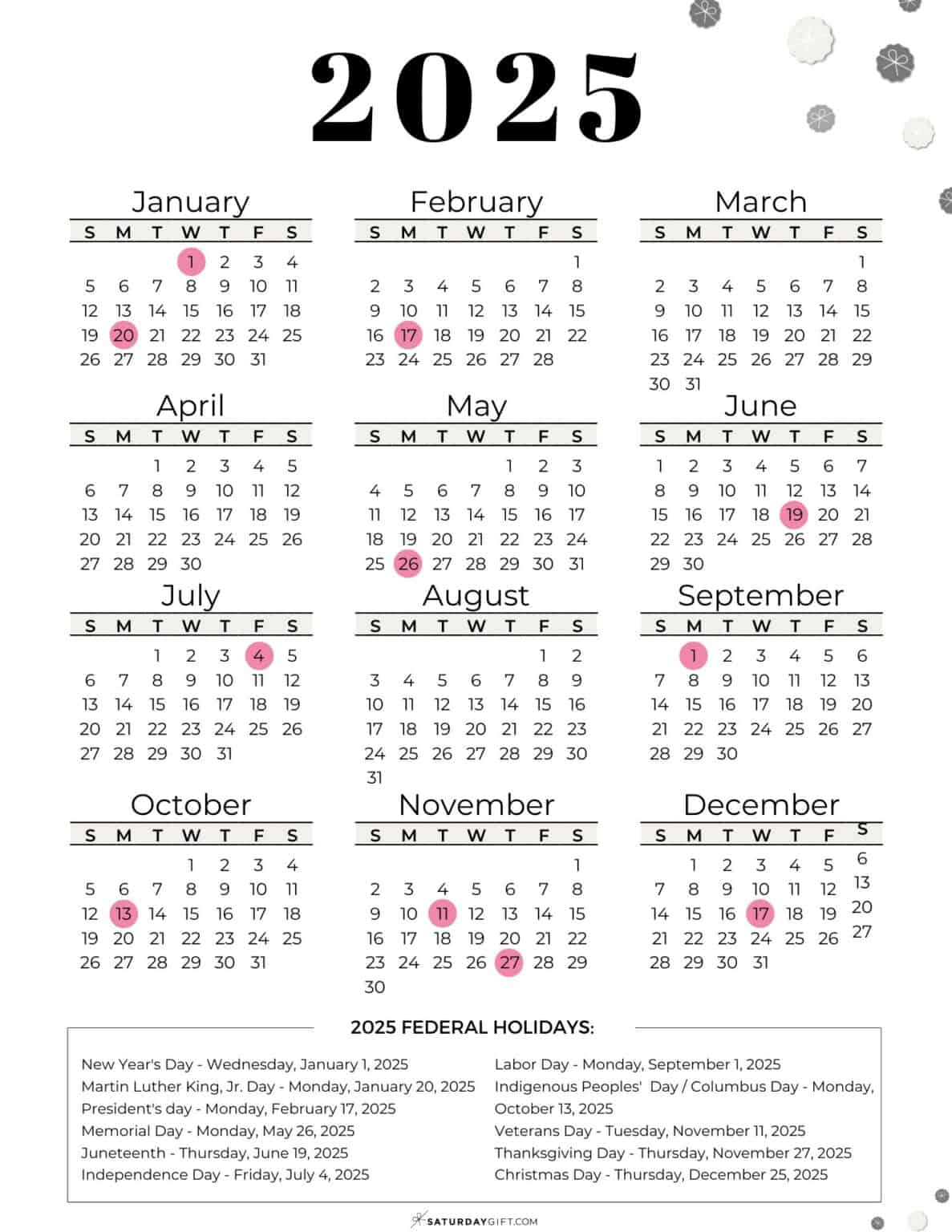

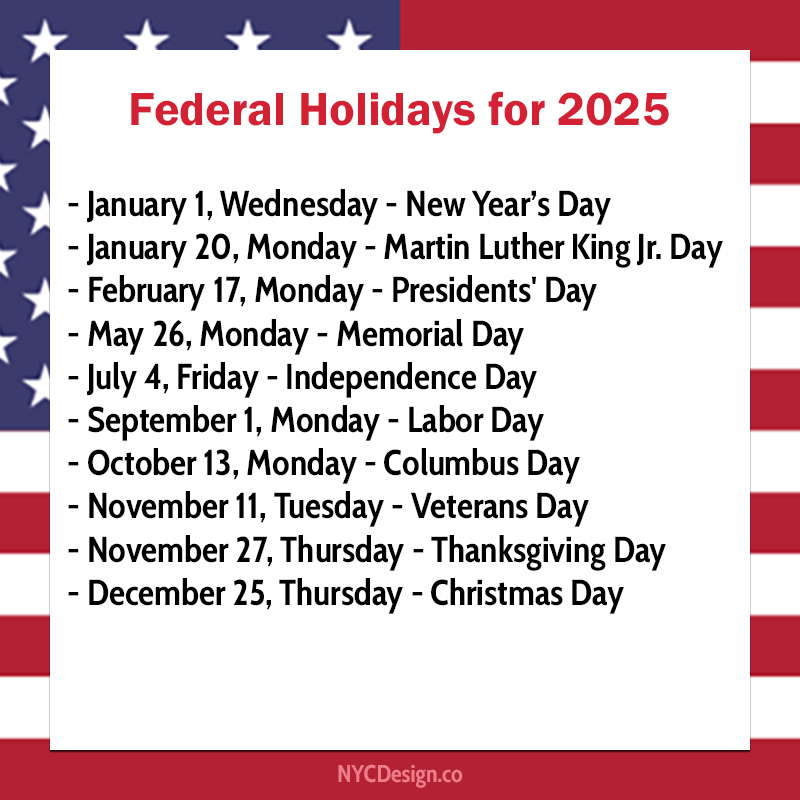

The Federal Reserve adheres to the holiday schedule established by the United States government. This schedule typically includes federal holidays, which are observed across the country. While the specific dates for these holidays can vary slightly from year to year, the following holidays are generally observed by the Federal Reserve in 2025:

- New Year’s Day: Observed on Monday, January 1st, 2025.

- Martin Luther King Jr. Day: Observed on Monday, January 20th, 2025.

- Presidents’ Day: Observed on Monday, February 17th, 2025.

- Memorial Day: Observed on Monday, May 26th, 2025.

- Independence Day: Observed on Wednesday, July 3rd, 2025 (observed on a Wednesday due to the holiday falling on a weekend).

- Labor Day: Observed on Monday, September 1st, 2025.

- Columbus Day: Observed on Monday, October 13th, 2025.

- Veterans Day: Observed on Monday, November 10th, 2025.

- Thanksgiving Day: Observed on Thursday, November 27th, 2025.

- Christmas Day: Observed on Wednesday, December 25th, 2025.

Impact of Federal Reserve Holidays on Financial Markets

The observance of holidays by the Federal Reserve can have a significant impact on financial markets. During these periods, the Federal Reserve’s operations, such as the processing of payments and the settlement of transactions, are typically suspended. This can lead to disruptions in market liquidity and potentially affect trading activity.

For example, on a holiday, the Federal Reserve’s Real-Time Gross Settlement (RTGS) system, which facilitates the transfer of funds between financial institutions, is typically unavailable. This can result in delays in payments and settlements, particularly for large-value transactions.

Importance of Federal Reserve Holidays

While the suspension of Federal Reserve operations during holidays can disrupt financial markets, it is essential to recognize the importance of these holidays. These holidays allow employees of the Federal Reserve to rest and recharge, ensuring their well-being and productivity. They also provide an opportunity for the Federal Reserve to perform essential maintenance and upgrades on its systems, improving their reliability and efficiency.

Frequently Asked Questions (FAQs)

Q: Are all Federal Reserve branches closed on holidays?

A: While most Federal Reserve branches are closed on holidays, some branches may remain open for essential services, such as cash management and check processing. It is advisable to contact the specific branch for confirmation.

Q: What happens to payments and settlements during holidays?

A: Payments and settlements are typically suspended during holidays. However, some institutions may offer alternative arrangements, such as expedited processing or extended deadlines. It is recommended to contact the relevant financial institution for details.

Q: How do holidays affect the stock market?

A: The stock market is typically closed on holidays, meaning that no trading occurs during these periods. However, the observance of holidays can impact the market’s performance in the days leading up to and following the holiday.

Tips for Navigating Federal Reserve Holidays

- Plan Ahead: Be aware of the Federal Reserve holiday schedule and plan your transactions accordingly.

- Check with Your Financial Institution: Contact your bank or financial institution to understand their policies regarding holiday operations.

- Consider Alternative Payment Methods: Explore alternative payment methods, such as electronic transfers, to avoid delays during holidays.

- Monitor Market Activity: Stay informed about market activity during and after holidays, as significant price movements can occur.

Conclusion

The Federal Reserve’s observance of holidays is an essential aspect of its operations, ensuring the well-being of its employees and the smooth functioning of its systems. While these holidays can disrupt financial markets, they are necessary to maintain the long-term health and stability of the economy. By understanding the impact of Federal Reserve holidays and taking appropriate measures, market participants can navigate these periods effectively.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Federal Reserve’s Observance of Holidays in 2025. We thank you for taking the time to read this article. See you in our next article!