Navigating the Financial Landscape: Understanding Federal Reserve Bank Holidays in 2025

Related Articles: Navigating the Financial Landscape: Understanding Federal Reserve Bank Holidays in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Financial Landscape: Understanding Federal Reserve Bank Holidays in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Financial Landscape: Understanding Federal Reserve Bank Holidays in 2025

The Federal Reserve System, the central banking system of the United States, plays a crucial role in maintaining financial stability and promoting economic growth. As a vital component of this system, the Federal Reserve Banks observe specific holidays, impacting financial operations and market activity. Understanding these holidays is essential for individuals and institutions alike, ensuring smooth transactions and informed decision-making.

Federal Reserve Bank Holidays: A Comprehensive Overview

Federal Reserve Bank holidays are officially designated days when the Federal Reserve Banks are closed for business. These closures affect various financial services, including:

- Check Clearing: The processing of checks is halted, delaying funds availability.

- Wire Transfers: Electronic fund transfers are generally suspended, impacting real-time transactions.

- Market Operations: The Federal Reserve’s open market operations, influencing interest rates and money supply, are put on hold.

- Federal Reserve Services: Other services provided by the Federal Reserve, such as providing currency to banks, are unavailable.

Determining Federal Reserve Bank Holidays in 2025

Federal Reserve Bank holidays are primarily determined by:

- Federal Holidays: The Federal Reserve observes all federal holidays. These include New Year’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, and Christmas Day.

- Floating Holidays: Some holidays, like Thanksgiving Day, fall on a specific week, but the exact date varies each year.

- Bank Holidays: While the Federal Reserve generally aligns with federal holidays, some banks may observe additional holidays specific to their region or institution.

The Importance of Understanding Federal Reserve Bank Holidays

Knowledge of Federal Reserve Bank holidays is crucial for:

- Financial Institutions: Banks and other financial institutions need to plan their operations, ensuring adequate staffing and contingency plans for handling potential disruptions.

- Businesses: Businesses reliant on financial transactions, particularly those involving interbank transfers or check processing, should factor in potential delays associated with holiday closures.

- Individuals: Individuals should be aware of potential delays in receiving payments, accessing funds, or completing financial transactions during these periods.

Federal Reserve Bank Holidays 2025: A Detailed Calendar

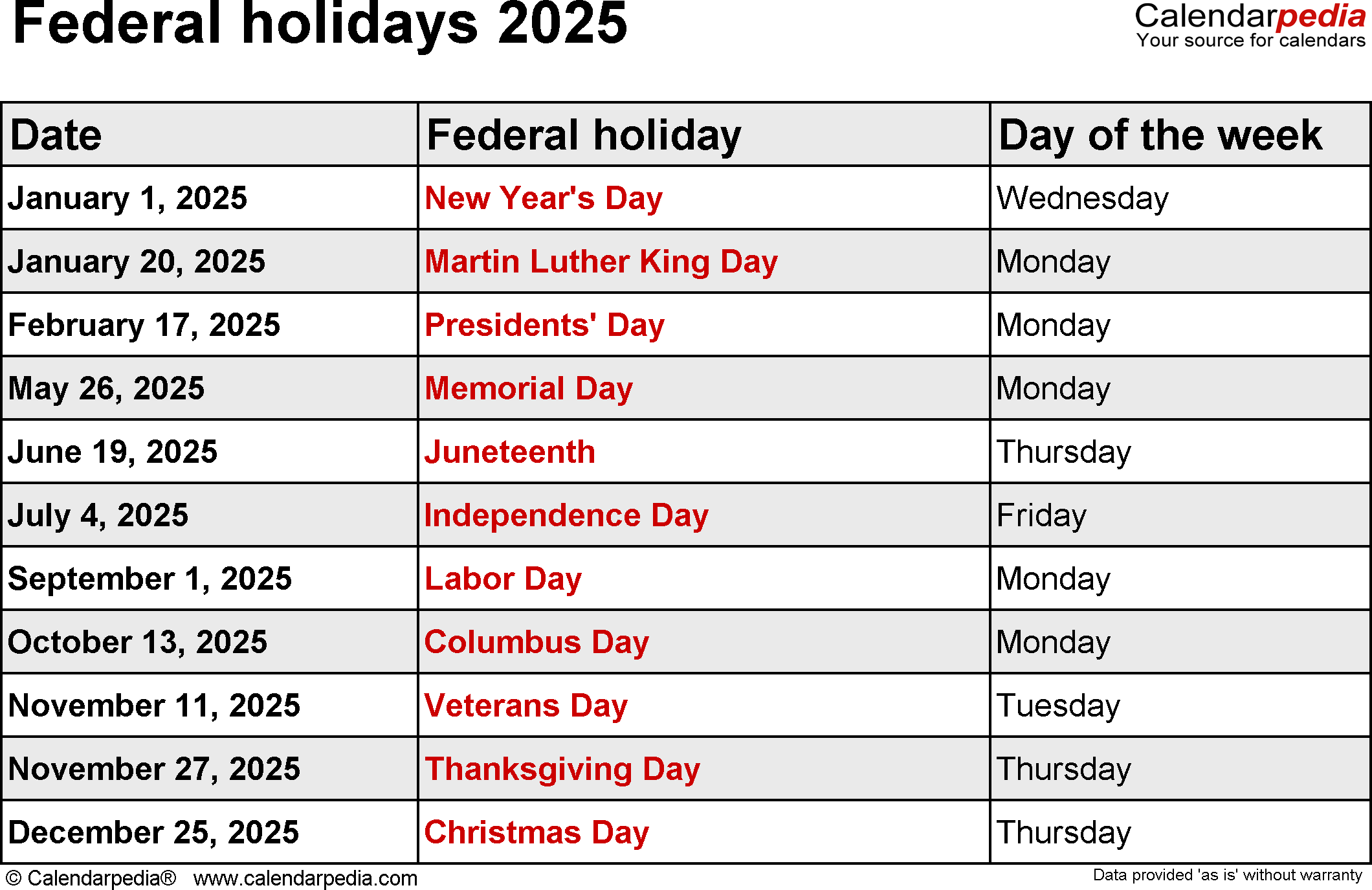

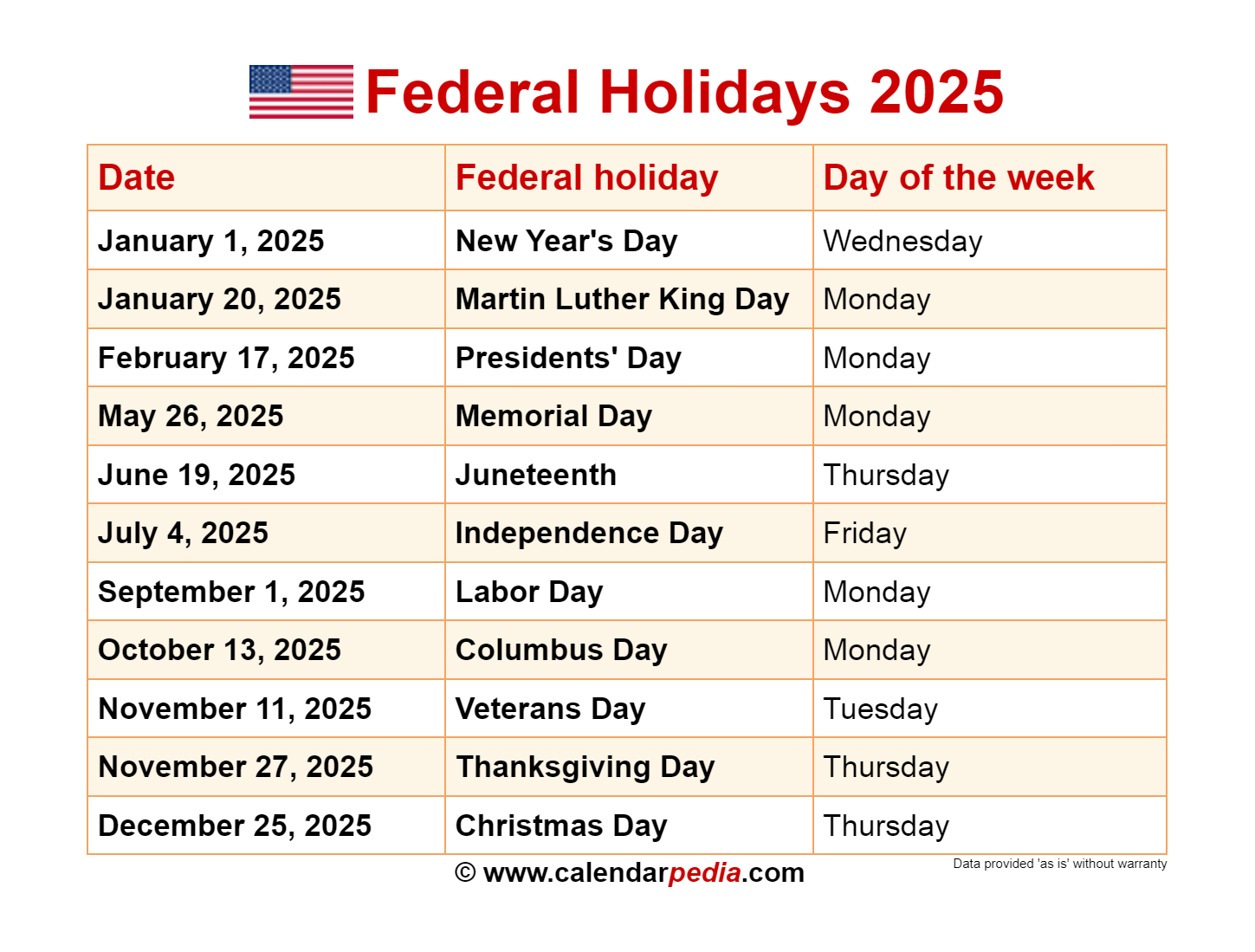

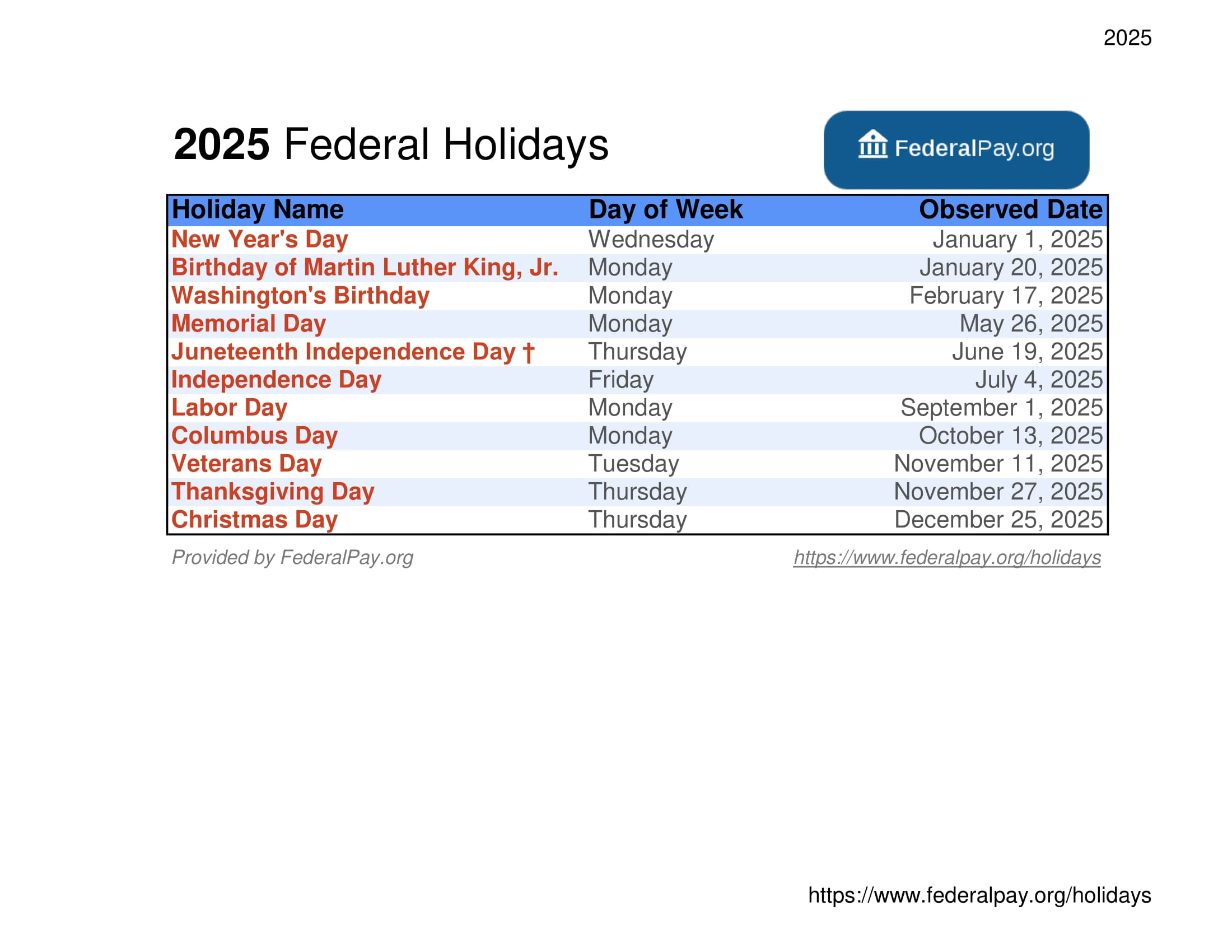

The following table outlines the anticipated Federal Reserve Bank holidays in 2025:

| Date | Day | Holiday |

|---|---|---|

| January 1 | Wednesday | New Year’s Day |

| January 20 | Monday | Martin Luther King Jr. Day |

| February 17 | Monday | Presidents’ Day |

| May 26 | Monday | Memorial Day |

| July 4 | Friday | Independence Day |

| September 1 | Monday | Labor Day |

| October 13 | Monday | Columbus Day |

| November 11 | Tuesday | Veterans Day |

| November 28 | Thursday | Thanksgiving Day |

| December 25 | Wednesday | Christmas Day |

Please note: This calendar is subject to change based on official announcements from the Federal Reserve. Individuals and organizations are encouraged to consult the official Federal Reserve website for the most up-to-date information.

FAQs Regarding Federal Reserve Bank Holidays

Q: What happens to financial markets on Federal Reserve Bank holidays?

A: Financial markets, including stock exchanges and bond markets, are generally closed on Federal Reserve Bank holidays. Trading activities are suspended, and market data is not available during these periods.

Q: Are all banks closed on Federal Reserve Bank holidays?

A: While most banks observe Federal Reserve Bank holidays, some banks may remain open for limited services or specific branches. It is advisable to contact individual banks for confirmation.

Q: What are the implications for wire transfers on Federal Reserve Bank holidays?

A: Wire transfers are typically suspended on Federal Reserve Bank holidays. Urgent transfers may be processed through alternative channels, but delays are likely.

Q: Can I still deposit checks on a Federal Reserve Bank holiday?

A: Check deposits may be accepted at ATMs or night deposit boxes, but processing will be delayed until the next business day.

Tips for Managing Finances During Federal Reserve Bank Holidays

- Plan Ahead: Schedule financial transactions, such as bill payments or wire transfers, well in advance of anticipated holidays.

- Check Bank Hours: Verify the operating hours of your bank during holiday periods, especially if you need to access funds or conduct in-person transactions.

- Use Online Services: Explore online banking options for managing accounts, transferring funds, or paying bills outside of regular banking hours.

- Consider Alternatives: For urgent transactions, consider alternative payment methods like mobile wallets or prepaid cards.

Conclusion

Federal Reserve Bank holidays are an integral part of the financial calendar, impacting various aspects of financial operations and market activity. By understanding these holidays and their implications, individuals, businesses, and financial institutions can navigate the financial landscape more effectively, minimizing disruptions and ensuring smooth transactions. Staying informed about official announcements and planning ahead are crucial for managing finances during these periods.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Financial Landscape: Understanding Federal Reserve Bank Holidays in 2025. We thank you for taking the time to read this article. See you in our next article!