Navigating Federal Holidays in 2025: A Comprehensive Guide for IRS Operations

Related Articles: Navigating Federal Holidays in 2025: A Comprehensive Guide for IRS Operations

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Federal Holidays in 2025: A Comprehensive Guide for IRS Operations. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Federal Holidays in 2025: A Comprehensive Guide for IRS Operations

The Internal Revenue Service (IRS) operates within a framework of federal holidays, days designated by the United States government for nationwide observance. These holidays impact IRS operations, influencing service availability, tax deadlines, and employee schedules. Understanding the nuances of these holidays is crucial for individuals and businesses interacting with the IRS.

2025 Federal Holidays and their Impact on IRS Operations

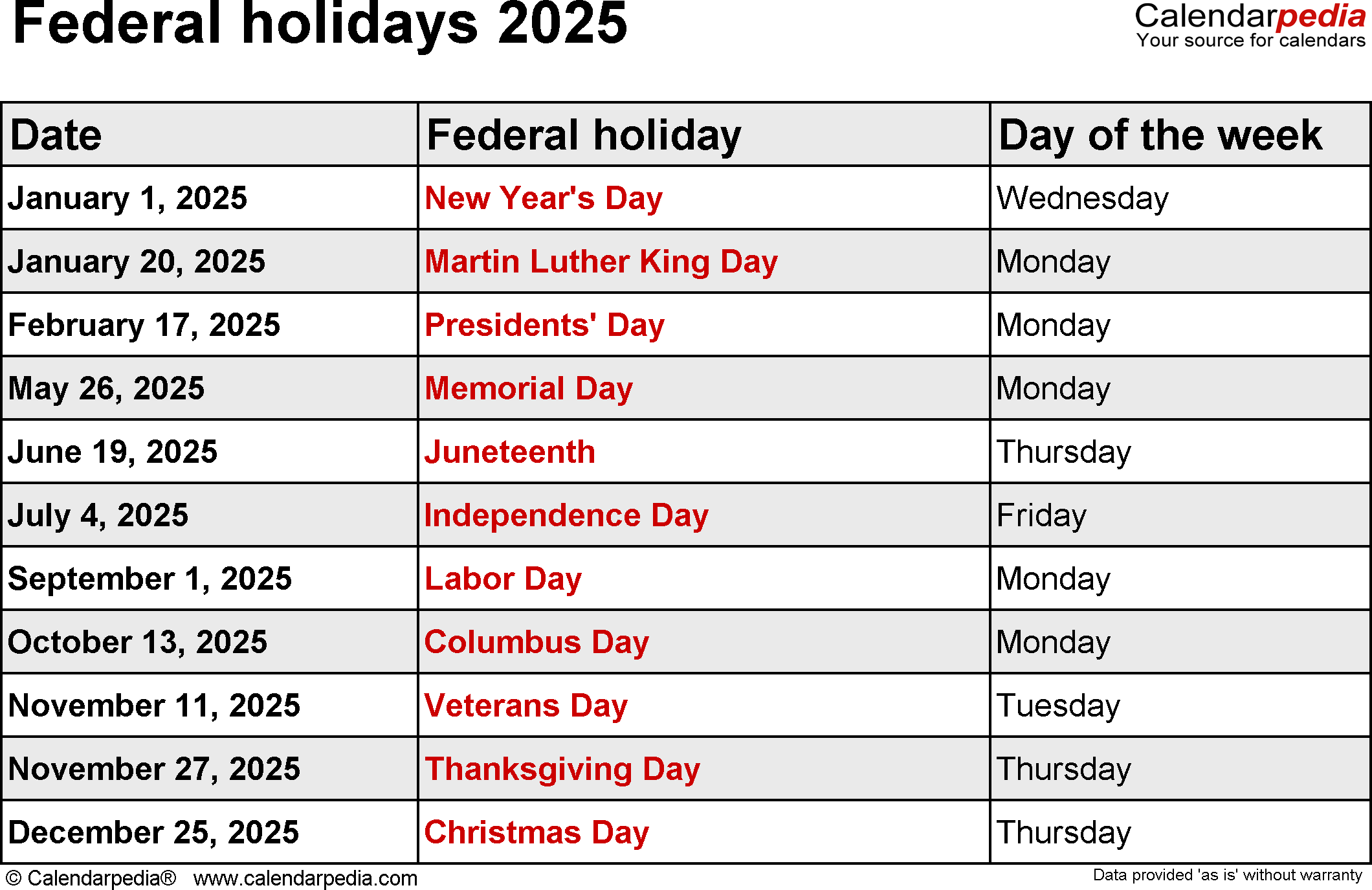

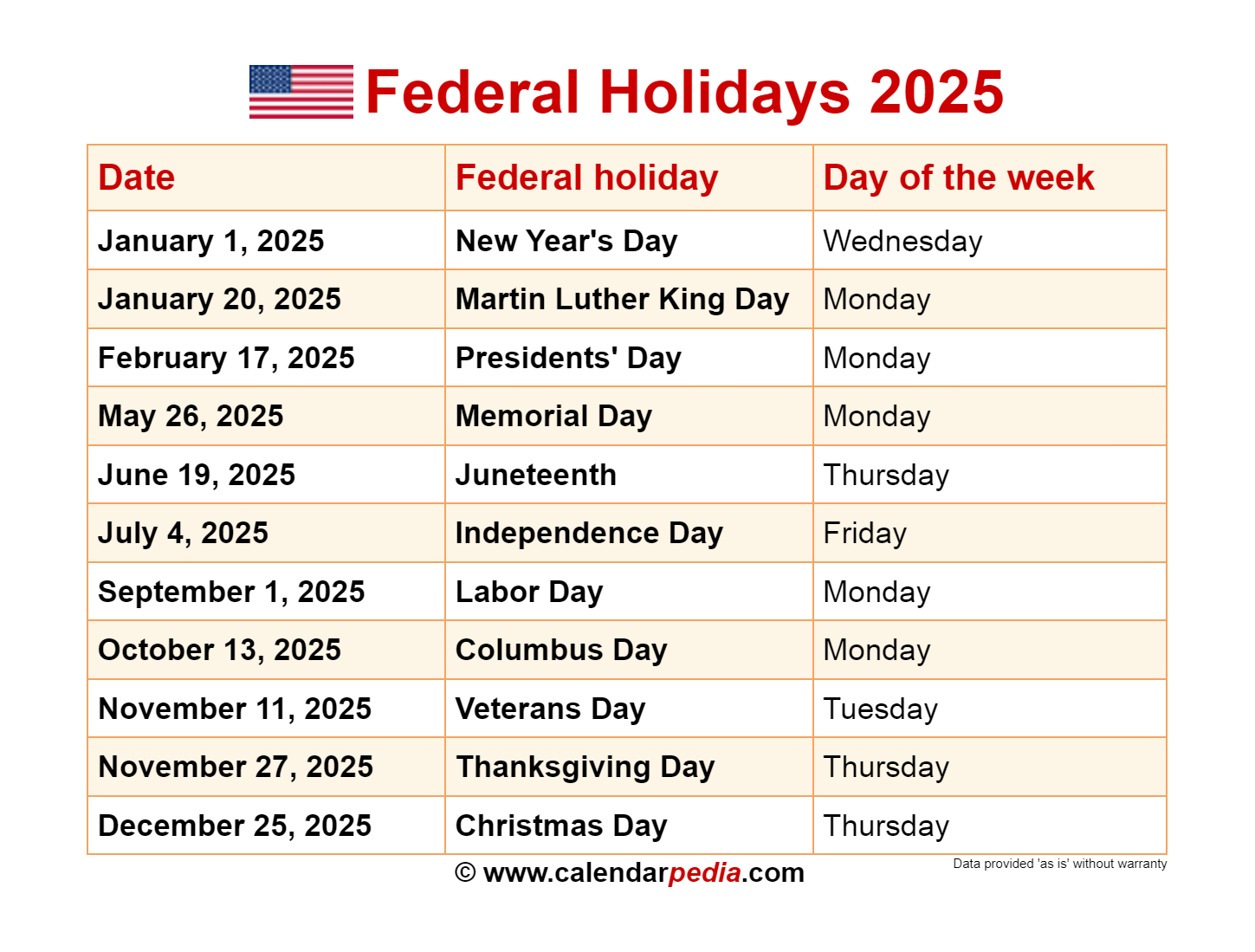

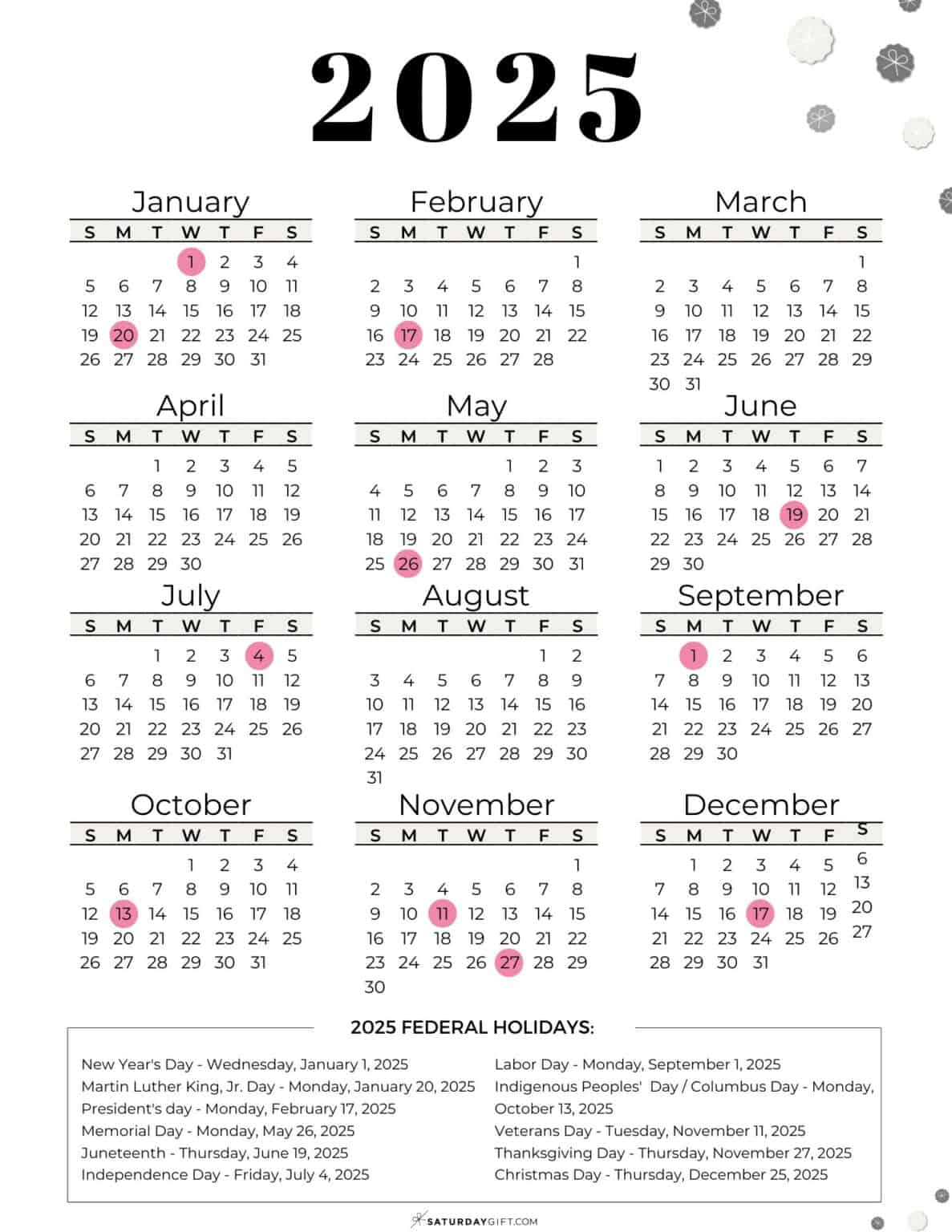

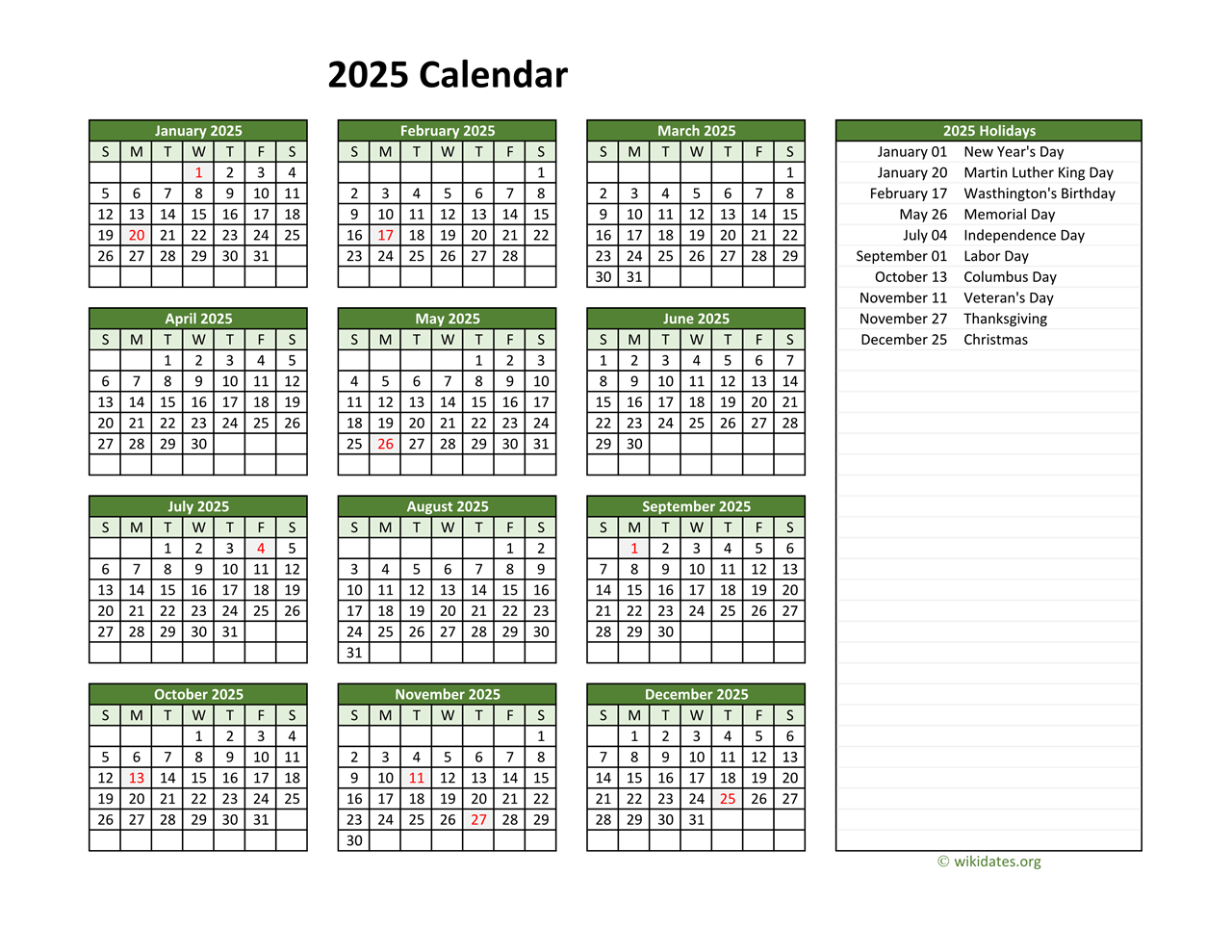

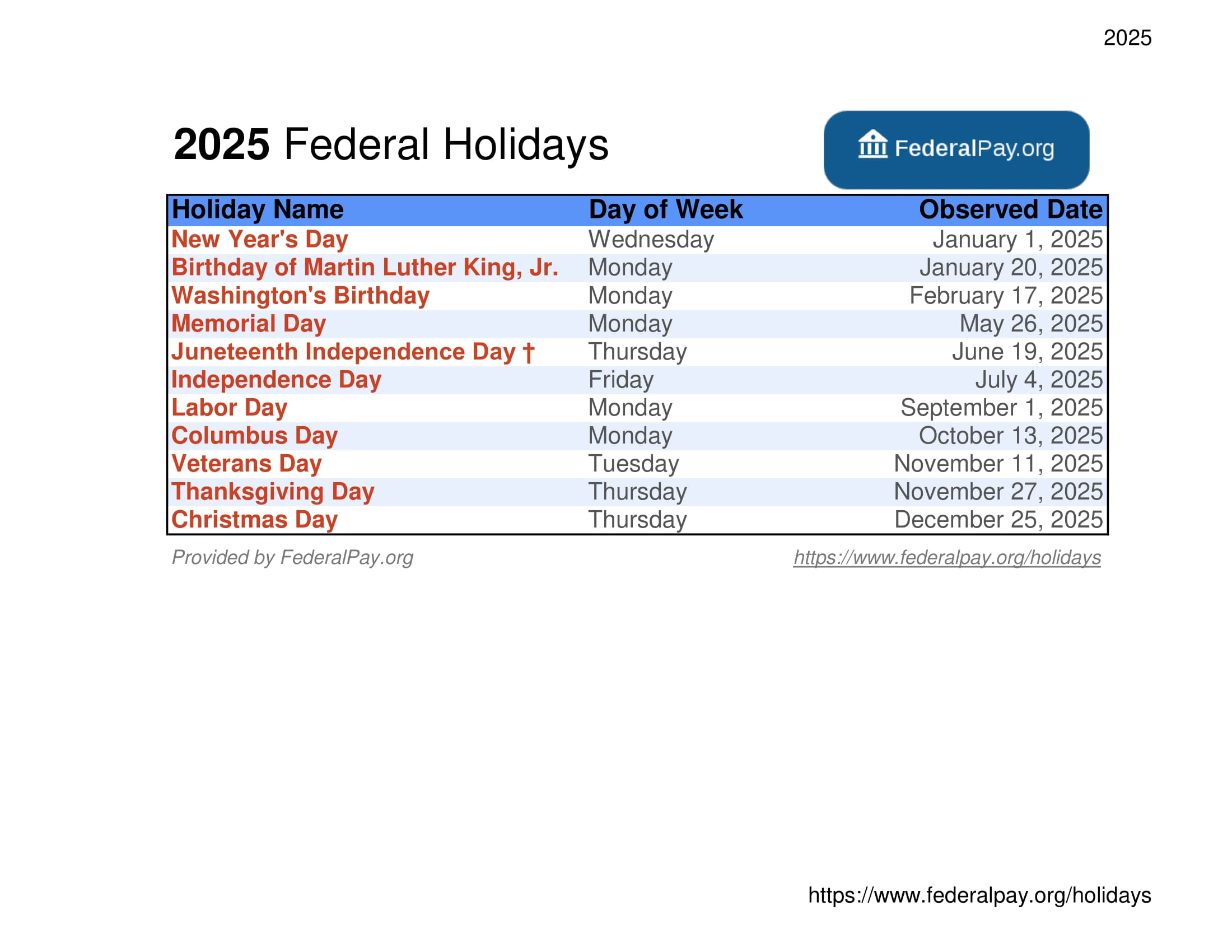

The following table outlines the federal holidays in 2025 and their potential implications for IRS operations:

| Date | Holiday | Impact on IRS Operations |

|---|---|---|

| January 1 | New Year’s Day | IRS offices closed. Processing and service delays may occur. |

| January 20 | Martin Luther King Jr. Day | IRS offices closed. Processing and service delays may occur. |

| February 17 | President’s Day | IRS offices closed. Processing and service delays may occur. |

| May 26 | Memorial Day | IRS offices closed. Processing and service delays may occur. |

| June 16 | Juneteenth National Independence Day | IRS offices closed. Processing and service delays may occur. |

| July 4 | Independence Day | IRS offices closed. Processing and service delays may occur. |

| September 1 | Labor Day | IRS offices closed. Processing and service delays may occur. |

| October 13 | Columbus Day | IRS offices closed. Processing and service delays may occur. |

| November 11 | Veterans Day | IRS offices closed. Processing and service delays may occur. |

| November 28 | Thanksgiving Day | IRS offices closed. Processing and service delays may occur. |

| December 25 | Christmas Day | IRS offices closed. Processing and service delays may occur. |

Understanding the Implications of IRS Closure

When IRS offices are closed, various services may be affected:

- Tax Filing and Payment: Taxpayers may experience delays in processing their returns or payments.

- IRS Website and Phone Lines: While the IRS website may remain accessible, response times for online services and phone calls may be slower.

- Mail Delivery: Mail delivery to and from the IRS is typically suspended on federal holidays.

- Tax Deadlines: Tax deadlines, such as filing extensions or payment due dates, may be shifted to the next business day if the original deadline falls on a holiday.

Benefits of Federal Holidays for IRS Operations

While federal holidays might cause temporary disruptions, they offer several benefits:

- Employee Well-being: Holidays provide employees with time for rest and rejuvenation, promoting a healthier and more productive workforce.

- Family Time: Holidays encourage families to spend quality time together, fostering stronger bonds and improving employee morale.

- Observance of National Significance: Holidays serve as reminders of important historical events and cultural values, promoting national unity and understanding.

FAQs Regarding Federal Holidays and IRS Operations

Q: Are tax deadlines extended if they fall on a federal holiday?

A: Yes, tax deadlines are typically extended to the next business day if they fall on a federal holiday. However, it is essential to confirm the specific deadline by checking the IRS website or contacting the agency directly.

Q: What happens to my tax refund if the IRS is closed on the day it is due to be issued?

A: Refunds are generally issued on the scheduled date, even if the IRS is closed. However, the funds may not be accessible in your bank account until the next business day.

Q: Can I still file my taxes online on a federal holiday?

A: Yes, you can typically file your taxes online on a federal holiday. However, the IRS website may experience higher traffic and slower response times due to increased usage.

Q: What if I miss a tax deadline due to a federal holiday?

A: The IRS generally grants extensions for missed deadlines if they were caused by unavoidable circumstances, including federal holidays. However, it is crucial to contact the IRS immediately to request an extension and provide supporting documentation.

Tips for Navigating Federal Holidays and IRS Operations

- Plan Ahead: Anticipate potential delays and plan your tax filing and payment activities accordingly.

- Stay Informed: Regularly check the IRS website for updates on holiday closures and service disruptions.

- Contact the IRS: If you have questions or require assistance, contact the IRS through their website, phone lines, or local office.

- Utilize Online Services: Leverage the IRS website and online tools for convenient and efficient tax filing and communication.

- Maintain Documentation: Keep records of all correspondence and transactions with the IRS, including any requests for extensions or adjustments.

Conclusion

Federal holidays play a significant role in shaping the operations of the IRS. Understanding their impact on service availability, tax deadlines, and employee schedules is crucial for individuals and businesses interacting with the agency. By planning ahead, staying informed, and utilizing available resources, taxpayers can navigate these holidays effectively and ensure their tax obligations are met efficiently.

Closure

Thus, we hope this article has provided valuable insights into Navigating Federal Holidays in 2025: A Comprehensive Guide for IRS Operations. We appreciate your attention to our article. See you in our next article!