Federal Holidays and the Federal Reserve in 2025: Navigating Financial Markets and Observing Traditions

Related Articles: Federal Holidays and the Federal Reserve in 2025: Navigating Financial Markets and Observing Traditions

Introduction

With great pleasure, we will explore the intriguing topic related to Federal Holidays and the Federal Reserve in 2025: Navigating Financial Markets and Observing Traditions. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Federal Holidays and the Federal Reserve in 2025: Navigating Financial Markets and Observing Traditions

The year 2025 will see the usual array of federal holidays, each marking significant events in American history and culture. While these days are primarily intended for celebration and remembrance, they also carry implications for the financial landscape, particularly in relation to the Federal Reserve. Understanding the interplay between federal holidays and the Federal Reserve’s operations is crucial for navigating financial markets and ensuring smooth business operations.

Understanding the Federal Reserve’s Role

The Federal Reserve, often referred to as the Fed, is the central bank of the United States. Its primary responsibilities include:

- Maintaining a stable financial system: The Fed monitors and regulates financial institutions to prevent systemic risk and ensure the smooth functioning of the economy.

- Controlling the money supply: Through various tools like interest rate adjustments and open market operations, the Fed influences the amount of money circulating in the economy to achieve price stability and economic growth.

- Providing financial services: The Fed acts as a lender of last resort to banks and facilitates payments between financial institutions.

Impact of Federal Holidays on Financial Markets

Federal holidays can impact financial markets in several ways:

- Trading Halts: Most financial markets, including the stock market, bond market, and foreign exchange markets, close on federal holidays. This means trading activities are suspended, leading to reduced liquidity and potential price volatility when markets reopen.

- Reduced Bank Operations: Banks and other financial institutions may operate with limited hours or be closed entirely on federal holidays. This can affect transactions, payments, and other financial services.

- Delayed Settlements: Settlements for trades and transactions may be delayed due to reduced operational capacity during holidays.

- Impact on Economic Data Releases: Some economic data releases, crucial for market analysis, may be postponed or delayed due to holidays.

Federal Holidays in 2025 and Their Potential Impact

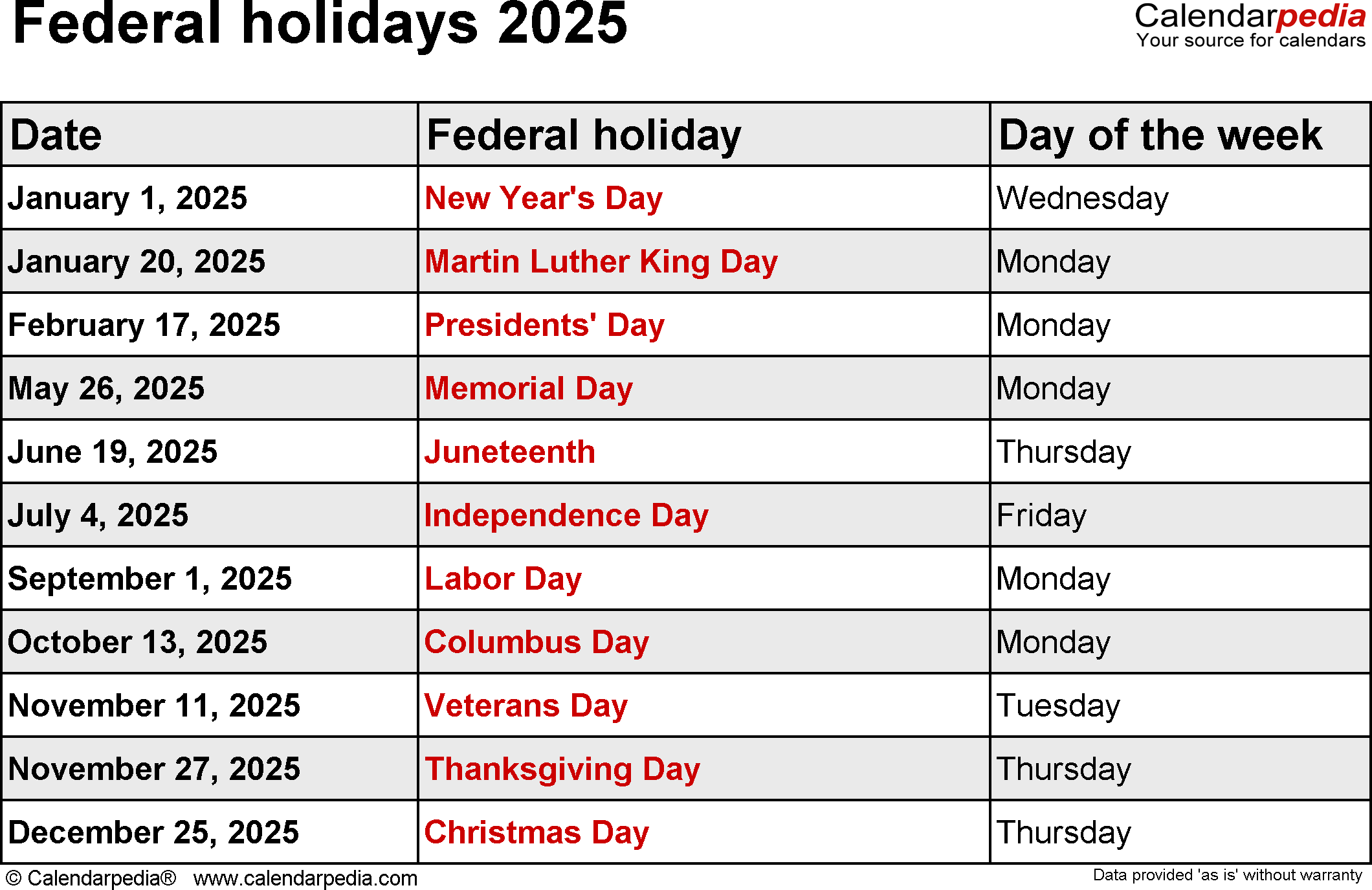

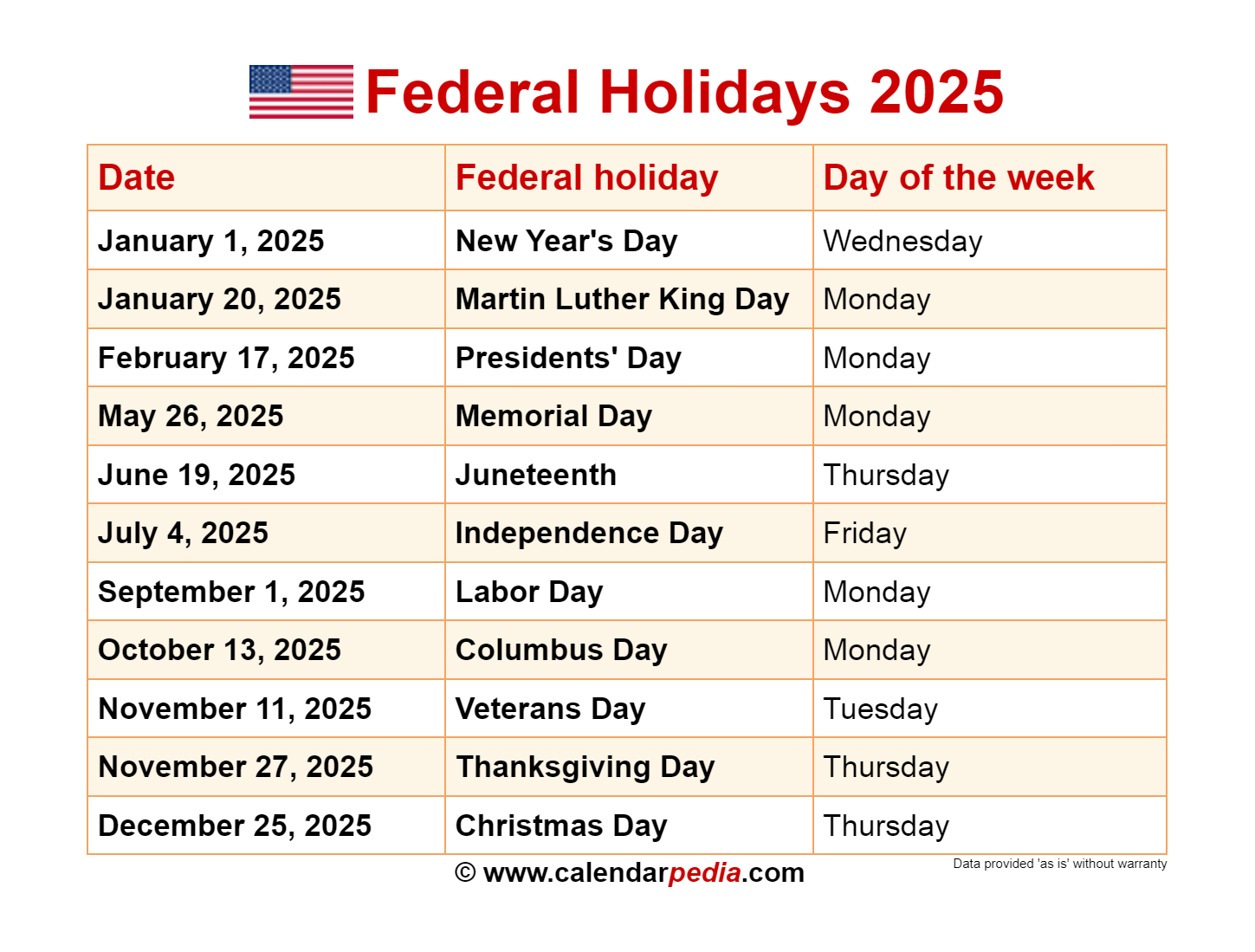

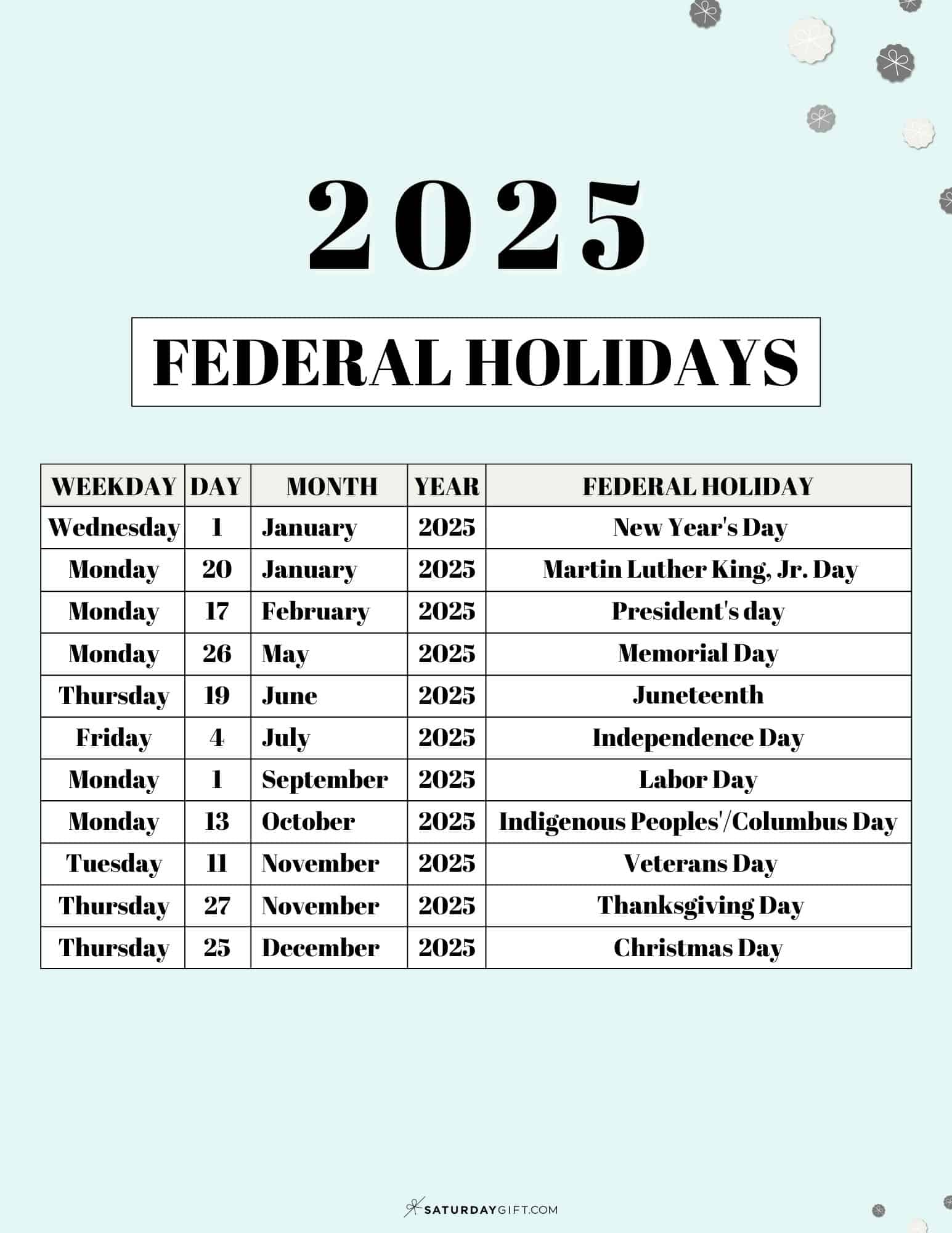

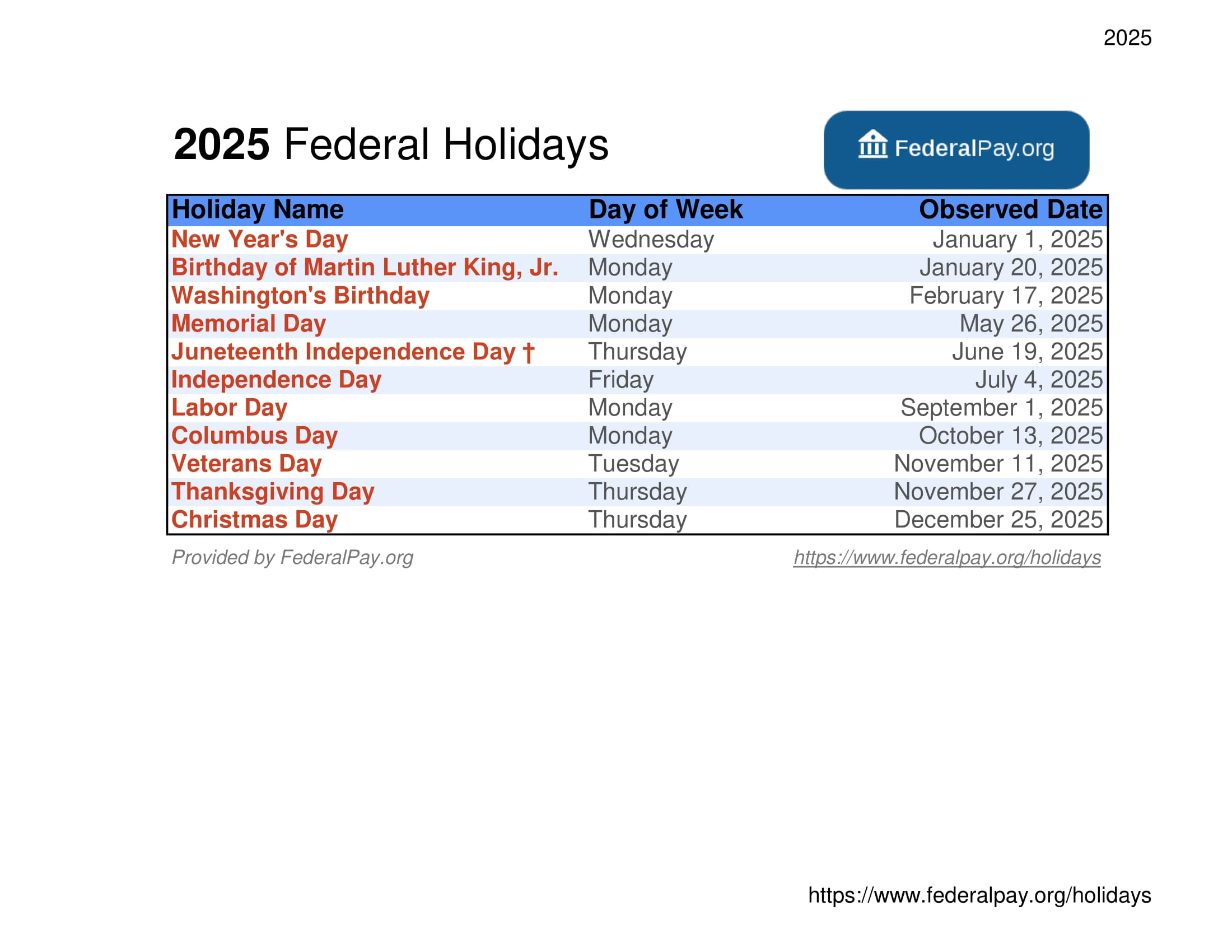

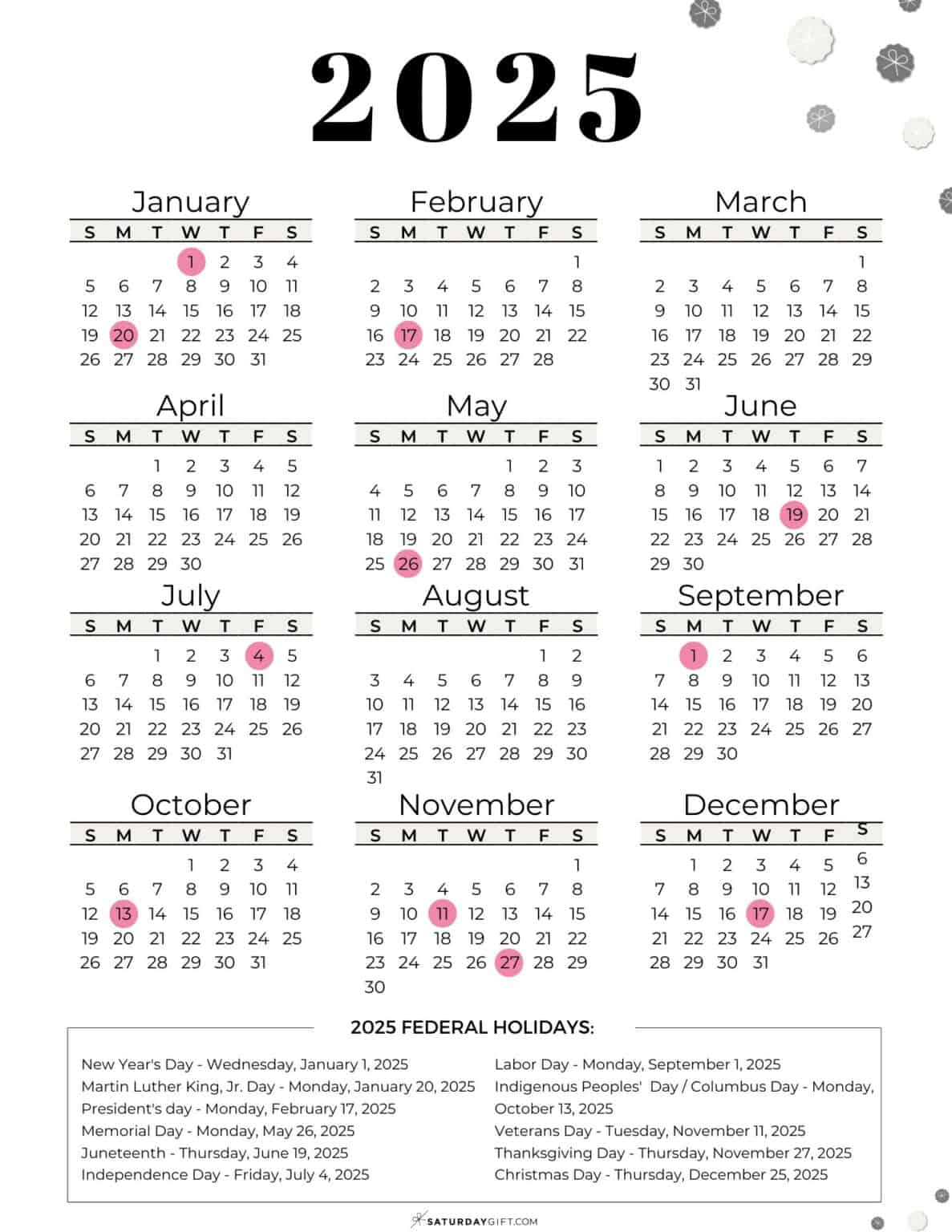

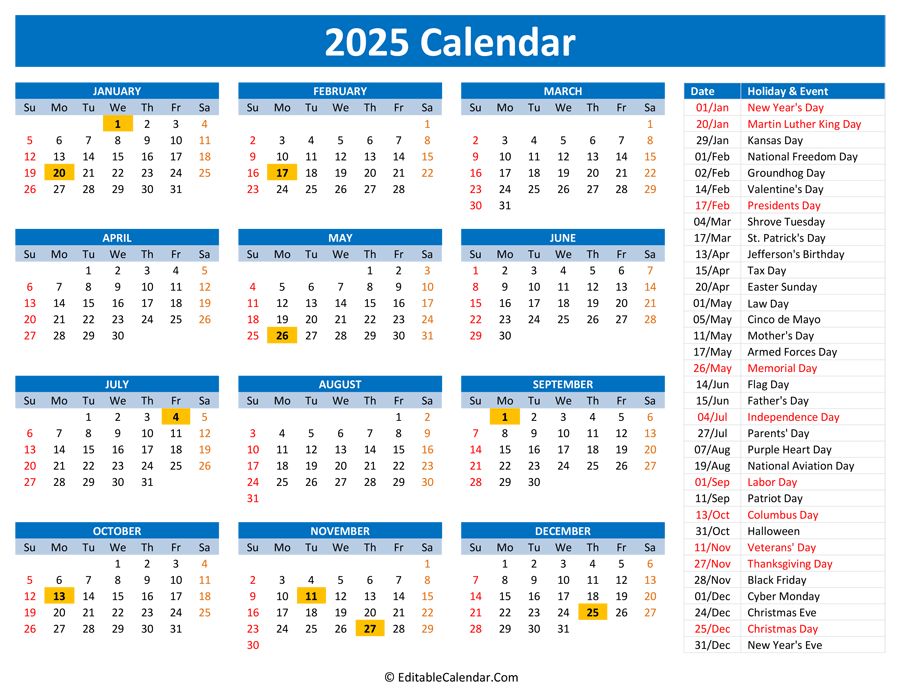

The following federal holidays are scheduled for 2025:

- New Year’s Day (Wednesday, January 1): This holiday typically marks the beginning of the year and is often associated with financial market forecasts and projections.

- Martin Luther King Jr. Day (Monday, January 20): This holiday commemorates the life and legacy of Dr. Martin Luther King Jr., a civil rights leader.

- Presidents’ Day (Monday, February 17): This holiday honors the birthdays of George Washington and Abraham Lincoln, two prominent presidents.

- Memorial Day (Monday, May 26): This holiday honors those who died while serving in the U.S. Armed Forces.

- Independence Day (Thursday, July 3): This holiday celebrates the signing of the Declaration of Independence, marking the birth of the United States.

- Labor Day (Monday, September 1): This holiday celebrates the contributions and achievements of American workers.

- Columbus Day (Monday, October 13): This holiday commemorates the arrival of Christopher Columbus in the Americas.

- Veterans Day (Friday, November 11): This holiday honors all U.S. military veterans.

- Thanksgiving Day (Thursday, November 27): This holiday is a time for family and gratitude, celebrated with a traditional feast.

- Christmas Day (Wednesday, December 25): This holiday celebrates the birth of Jesus Christ and is widely observed across the country.

Navigating Financial Markets During Holidays

For investors, traders, and financial professionals, understanding the impact of federal holidays on financial markets is crucial. It is advisable to:

- Stay Informed: Monitor market announcements and news updates regarding trading hours and settlement procedures during holidays.

- Plan Ahead: Anticipate potential market volatility and liquidity constraints and adjust trading strategies accordingly.

- Consider Alternative Investments: Explore investment options that remain active during holidays, such as certain foreign exchange markets.

- Monitor Economic Data: Pay attention to any potential delays or postponements in economic data releases and adjust your analysis accordingly.

FAQs

Q: Does the Federal Reserve operate on federal holidays?

A: The Federal Reserve does not operate on federal holidays. However, it may announce important policy decisions or release statements even on holidays, depending on the urgency of the situation.

Q: Are financial markets closed on all federal holidays?

A: While most major financial markets close on federal holidays, some exceptions may exist, particularly for foreign exchange markets.

Q: How do holidays affect interest rates and monetary policy?

A: While the Federal Reserve does not typically make significant policy changes on holidays, unexpected events or economic developments could necessitate immediate action.

Q: What are the best strategies for managing investments during holidays?

A: During holidays, it’s generally recommended to maintain a cautious approach, avoid making significant trades, and focus on monitoring market trends and news updates.

Tips for Businesses

- Plan Ahead: Businesses should anticipate reduced operational capacity and potential delays in financial transactions during holidays.

- Communicate Effectively: Inform customers and clients about potential disruptions to services and adjust business hours accordingly.

- Ensure Adequate Staffing: Allocate resources to ensure essential operations can continue even with limited staff.

- Review Payment Procedures: Confirm payment processing and settlement deadlines to avoid delays.

- Monitor Market Trends: Stay informed about market movements and potential impacts on business operations.

Conclusion

Federal holidays are an integral part of American life, offering opportunities for celebration and reflection. While these days are marked by festivities and time off, they also have implications for financial markets and the operations of the Federal Reserve. By understanding the interplay between holidays and the financial landscape, individuals and businesses can navigate these periods effectively, ensuring smooth operations and minimizing potential disruptions.

Closure

Thus, we hope this article has provided valuable insights into Federal Holidays and the Federal Reserve in 2025: Navigating Financial Markets and Observing Traditions. We appreciate your attention to our article. See you in our next article!